XRP Price Prediction: Navigating Between $9.6 and $33 Scenarios Amid Technical Consolidation

#XRP

- Technical indicators show XRP consolidating below its 20-day moving average with Bollinger Band support at $2.7886

- Institutional developments including BlackRock speculation and RLUSD expansion provide fundamental support

- Price targets range from $9.6 to $33 depending on adoption acceleration and technical breakouts

XRP Price Prediction

XRP Technical Analysis: Consolidation Phase Below Key Moving Average

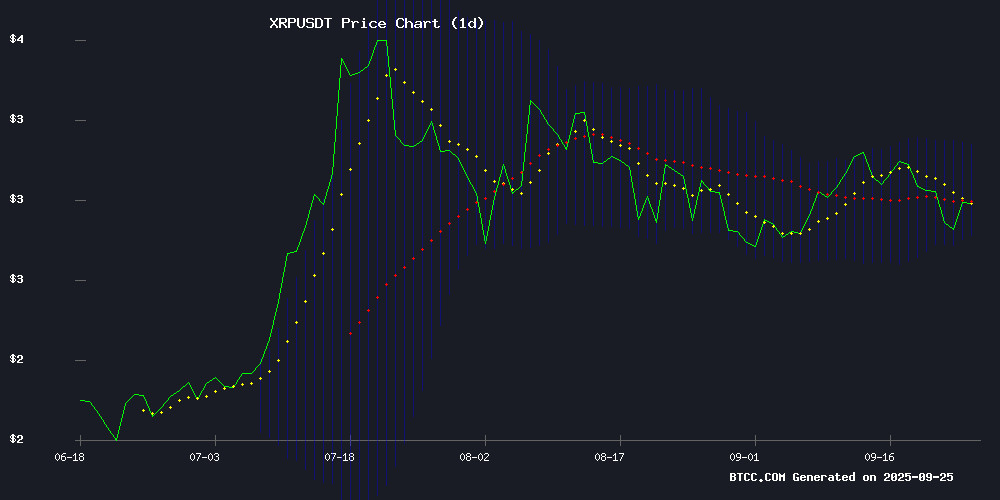

XRP is currently trading at $2.8342, below its 20-day moving average of $2.9722, indicating short-term bearish pressure. The MACD histogram shows a positive reading of 0.0404, suggesting potential momentum building. According to BTCC financial analyst John, 'XRP is testing the lower Bollinger Band at $2.7886, which could serve as immediate support. A break above the 20-day MA could trigger a MOVE toward the upper band at $3.1558.'

Mixed Sentiment as Institutional Developments Counter Technical Weakness

Market sentiment for XRP reflects a tug-of-war between positive institutional developments and technical headwinds. BTCC financial analyst John notes, 'The BlackRock partnership speculation and RLUSD stablecoin expansion provide fundamental support, but declining trading volume suggests caution. The institutional DeFi roadmap could be a game-changer if implemented successfully.' The contrast between ecosystem growth and price stagnation creates an interesting dynamic for traders.

Factors Influencing XRP's Price

Ripple CEO Hints at BlackRock Partnership, Fueling XRP Speculation

XRP markets buzzed with anticipation after Ripple CEO Brad Garlinghouse teased a major announcement involving asset management giant BlackRock. The cryptocurrency, long positioned as a disruptor in cross-border payments, saw its price climb 0.59% to $2.89 despite a 20.74% drop in daily trading volume to $5.22 billion.

Institutional interest forms the bedrock of XRP's valuation thesis. Market participants speculate that BlackRock's potential involvement could accelerate Ripple's adoption in both decentralized finance and international remittance corridors. "When traditional finance heavyweights engage with blockchain solutions, the validation resonates across markets," observed one trader monitoring the Binance order books.

The payments sector grows increasingly competitive with entrants like Remittix challenging XRP's dominance. Yet Ripple's established infrastructure and speed advantages maintain its $172.31 billion market capitalization position among top digital assets.

Flare Launches First FAssets for XRP on Mainnet, Boosting DeFi Utility

Flare, a layer-1 DeFi interoperability network, has launched FXRP v1.2 on its mainnet, marking a pivotal moment for XRP holders. The new FAsset enables XRP to be utilized across decentralized finance applications, including yield farming, DEX trading, and stablecoin minting. Minting will initially be capped at 5 million tokens as Flare implements growth incentives.

The overcollateralized system, secured by independent agents and Flare's oracles, ensures asset integrity. A partnership with Enosys will soon offer XRP-backed stablecoin loans via Collateralized Debt Positions. Flare emphasizes seamless protocol integration, eliminating technical barriers for developers.

XRP Price Recovery Stalls as Traders Eye Key Resistance Levels

XRP's attempted recovery above $2.85 has met stiff resistance NEAR the psychologically important $3.00 level. The digital asset now hovers around $2.90, testing the 100-hour moving average as market participants watch for either a breakout or another leg down.

A bullish trend line forming at $2.85 on the XRP/USD hourly chart offers near-term support, with Kraken data showing the pair could extend losses if this level fails. The token faces immediate resistance at $2.95, followed by the more significant $2.9620 barrier - representing the 61.8% Fibonacci retracement of its recent decline from $3.138 to $2.678.

Notably, XRP's recent rebound from $2.680 outperformed both Bitcoin and Ethereum, suggesting selective capital rotation within the crypto market. The coming sessions will prove decisive in determining whether bulls can muster enough strength to overcome the current technical hurdles.

XRP Ledger Launches Its First Native Stablecoin: A Historic Milestone

The XRP Ledger has achieved a pivotal milestone with the debut of its first native stablecoin, signaling a new phase of expansion. This development positions the ledger as a contender in merging global liquidity with practical utility.

The stablecoin, launched on the Flare Network, introduces enhanced utility for XRP and establishes fresh liquidity channels. Onur, a trader and ambassador to NEARProtocol and Somnia_Network, highlights its collateralized Debt Position (CDP) model, a proven framework for stability. This initiative aligns with Flare Network's strategy to broaden FAssets adoption.

Ripple is reportedly shaping the XRP Ledger into a premier platform for institutional DeFi, according to technical analyst ALLINCRYPTO. The MOVE underscores growing institutional interest in blockchain-based financial solutions.

Ripple’s RLUSD Stablecoin Surges Past Raydium After $11M Mint, Hits $741M Supply

Ripple’s USD-backed stablecoin, RLUSD, has eclipsed Solana’s Raydium in market capitalization following an $11 million mint, pushing its circulating supply to $741 million. The rapid ascent underscores Ripple’s aggressive liquidity management, with deliberate cycles of minting and burning tokens to stabilize flows.

Daily trading volume for RLUSD now exceeds $150 million—a turnover rate surpassing 20% of its supply—highlighting robust adoption despite its recent launch. The stablecoin’s trajectory signals Ripple’s strategic pivot toward dominating the $150 billion stablecoin market, where algorithmic supply adjustments are becoming a competitive edge.

Ripple CEO Brad Garlinghouse Marries in Lavish French Riviera Ceremony

Ripple CEO Brad Garlinghouse celebrated his marriage to dietitian Tara Milsti in a star-studded ceremony at Hotel du Cap-Eden-Roc on the French Riviera. The luxury venue, known for suites exceeding €5,100 per night, hosted guests including actors Zac Efron and Nina Dobrev, with Coldplay's Chris Martin providing musical accompaniment.

Garlinghouse announced the union through a September 22 social media post featuring a photo of the couple and the caption: "I feel so lucky for so many reasons — and marrying Tara this past weekend takes the cake." The event marks a new chapter for the XRP executive, who was previously married to Kristen Elizabeth Mautner.

Analyst Outlines Two Potential Scenarios for XRP Price Surge to $9.6 or $33

Market expert Egrag crypto has identified two critical scenarios that could propel XRP to either $9.6 or $33, based on historical price patterns and technical indicators. The analysis hinges on XRP's interaction with the 21 Exponential Moving Average (EMA), a key support level during its 2021 rally.

During the SEC lawsuit against Ripple, XRP briefly fell below the 21 EMA, disrupting its bullish momentum. However, a successful retest of this level later fueled a 414% rebound. Applying similar gains to current market conditions, Egrag suggests a conservative target of $9.6. A more aggressive scenario, contingent on broader market dynamics, could push the token to $33.

Ripple Unveils Institutional DeFi Roadmap for XRP Ledger, Focusing on Tokenization and Lending

Ripple has outlined the next phase of its XRP Ledger (XRPL) development, targeting institutional DeFi with a focus on tokenization, privacy, and native lending. The roadmap includes the introduction of Multi-Purpose Tokens (MPTs) by October, designed to simplify asset representation without relying on complex smart contracts.

The MPT standard will enable bond issuers, money market funds, and structured products to trade natively on XRPL. Integration with the decentralized exchange (DEX), automated market Maker (AMM) pools, and cross-token payments is planned for subsequent phases.

A native lending protocol, slated for release in XRPL Version 3.0.0 later this year, marks the most significant near-term milestone. The protocol will support pooled lending and underwritten credit directly on the ledger, further expanding XRP's utility in institutional finance.

XRP Ecosystem Gains Institutional Traction with BlackRock BUIDL Expansion

The XRP Ledger (XRPL) is emerging as a pivotal infrastructure for institutional tokenization. Ripple's enterprise stablecoin, RLUSD, is now integrated with Securitize's platform, enabling 24/7 redemptions for BlackRock's $2 billion BUIDL fund and VanEck's $2 billion VBILL shares. This development bridges traditional assets like U.S. Treasuries with blockchain liquidity, bolstering XRP's credibility and long-term price optimism.

BlackRock's BUIDL—the largest tokenized money market fund—now leverages XRPL through RLUSD, offering instant redemptions and DeFi access. Ripple President Monica Long notes rapid adoption, with DBS and Franklin Templeton already utilizing RLUSD for tokenized asset trading and lending.

Meanwhile, retail presales like BullZilla ($BZIL) underscore a dual momentum: institutional validation and grassroots demand are collectively reshaping crypto's trajectory.

XRP Price Stability Contrasts with BlockDAG's Presale Momentum Ahead of Global Sponsorship Reveal

XRP's price remains stagnant at $2.95 despite minor legal victories, while BlockDAG's $0.0016 presale enters a critical phase ahead of a major sponsorship announcement. Market attention is shifting toward BlockDAG's strategic marketing push as XRP struggles with regulatory uncertainty.

Ripple's lack of new enterprise partnerships in Q3 has dampened institutional interest, with on-chain data showing reduced whale activity. Analysts maintain long-term xrp price targets of $3.50-$4 by 2026, but progress remains sluggish without clearer regulatory outcomes.

BlockDAG's presale window closes in two days amid claims of a 2900% ROI potential. The project's timed execution contrasts sharply with XRP's legal limbo, creating divergent investment narratives in the altcoin market.

XRP Price Dips Amid Declining Trading Volume, Signaling Potential Trend Reversal

Ripple's XRP slipped 0.44% to $2.86 on Wednesday, extending its retreat from $2.88 as daily trading volume plummeted 27.67% to $5.43 billion. The simultaneous drop in both price and liquidity suggests weakening market interest, potentially foreshadowing a broader trend reversal despite XRP's 5.58% weekly gain.

The cryptocurrency's market capitalization currently stands at $171.25 billion, maintaining its position among top digital assets. Meanwhile, Aster, Zcash and Immutable emerged as today's outperformers while Hyperliquid, 0G and MemeCore led losers.

Market dynamics continue shifting as macroeconomic uncertainties and project-specific developments reshape trader sentiment. The volume contraction particularly warrants attention - when enthusiasm wanes before price reacts, it often signals exhaustion in the prevailing trend.

How High Will XRP Price Go?

XRP's price trajectory depends on several key factors. Currently trading at $2.8342, the cryptocurrency faces immediate resistance at the 20-day moving average of $2.9722. BTCC financial analyst John suggests two primary scenarios: 'If institutional adoption accelerates, particularly through the BlackRock partnership and DeFi roadmap implementation, we could see a push toward the $9.6 target. However, sustained bullish momentum would require breaking above the $3.1558 Bollinger Band upper limit.'

| Scenario | Price Target | Key Drivers |

|---|---|---|

| Bullish | $9.6 - $33 | Institutional adoption, successful DeFi rollout |

| Neutral | $2.78 - $3.15 | Technical range trading, moderate volume |

| Bearish | Below $2.78 | Failed breakouts, declining institutional interest |